- The Weekly Mensch

- Posts

- The Weekly Mensch: Marc Rich

The Weekly Mensch: Marc Rich

The dealmaker who rewrote the rules of global trade through bold moves

Us in a Nutshell

We are passionate about the lives, the impact, and the experience of Jewish baby boomers who have changed our world. From finance to the arts, we write about the stories of contemporary heroes who — significantly and meaningfully — changed the face of their respective industries, often starting with nothing but a legacy of exile. We tell their stories for the timeless lessons of intelligence, ethics, and resilience they underline. And we also share some fun anecdotes! Nathan Tob is a fourth-year student at the Queen Mary University of London. He studies Economics, Finance, and Management. Davy Sokolski is a third-year student at Columbia University in New York. He studies International Political Economy.

What is a Mensch?

Leo Rosten defines mensch as “someone to admire and emulate, someone of noble character.” Dr. Saul Levine writes in Psychology Today that a mensch’s personality characteristics include decency, wisdom, kindness, honesty, trustworthiness, respect, benevolence, compassion, and altruism.

Marc’s Rapid Bio

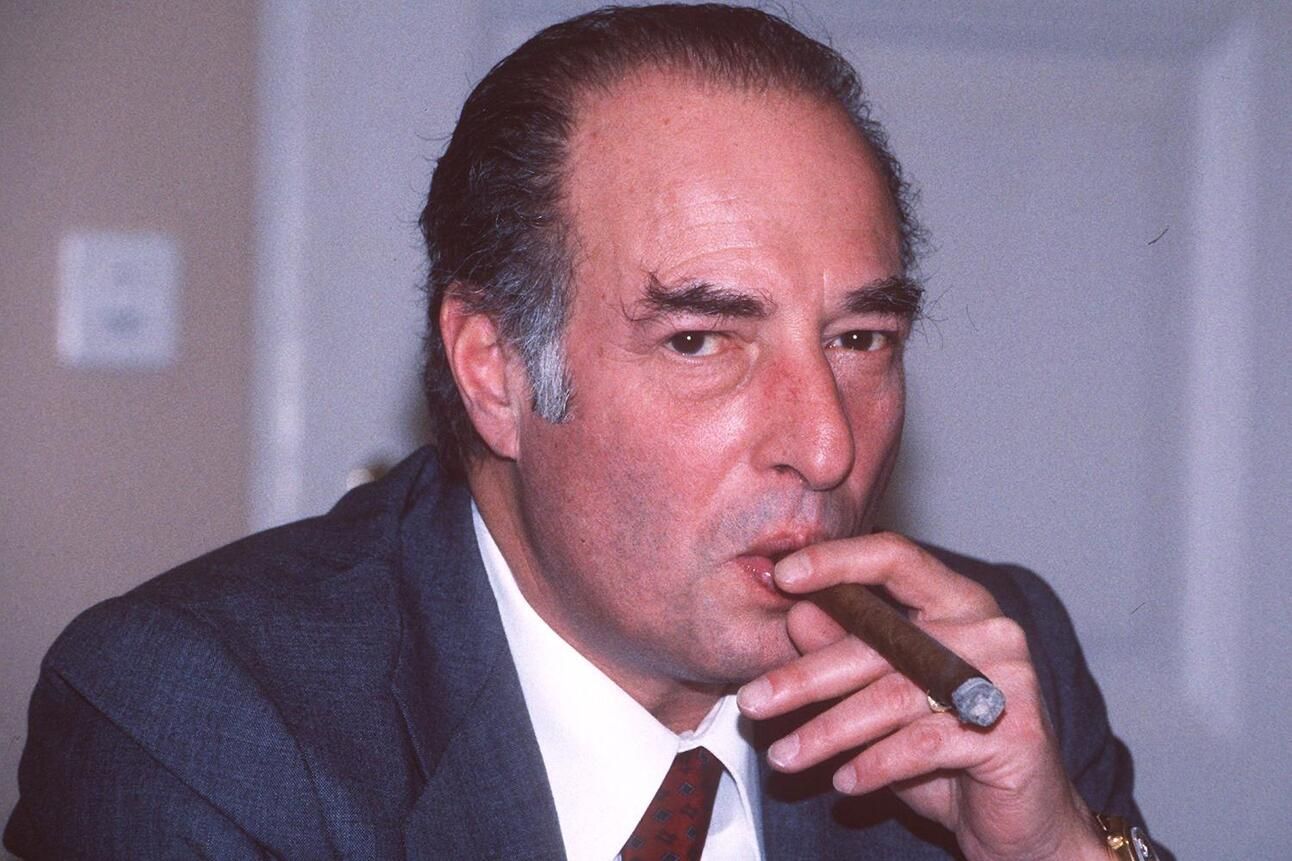

Credit: The Times

Marc David Reich (later Rich), was born on December 18, 1934, in Antwerp, Belgium, to a Jewish family that fled to the United States in 1941 to escape Nazi persecution. Growing up in Kansas City and later in Queens, New York, Rich was deeply influenced by the resilience and business acumen of his father, David Reich, a scrap metal dealer who built a successful enterprise from the ground up. From an early age, Rich absorbed lessons in risk-taking, negotiation, and recognizing value where others did not.

He briefly attended New York University but left before graduating, choosing to gain real-world experience instead. He began his career at Philipp Brothers (Phibro), then the world’s leading commodities trading firm, where he mastered the intricacies of global markets. By his early 30s, he was recognized as one of the most innovative traders in the firm, pioneering long-term oil contracts and direct dealings with governments instead of traditional middlemen.

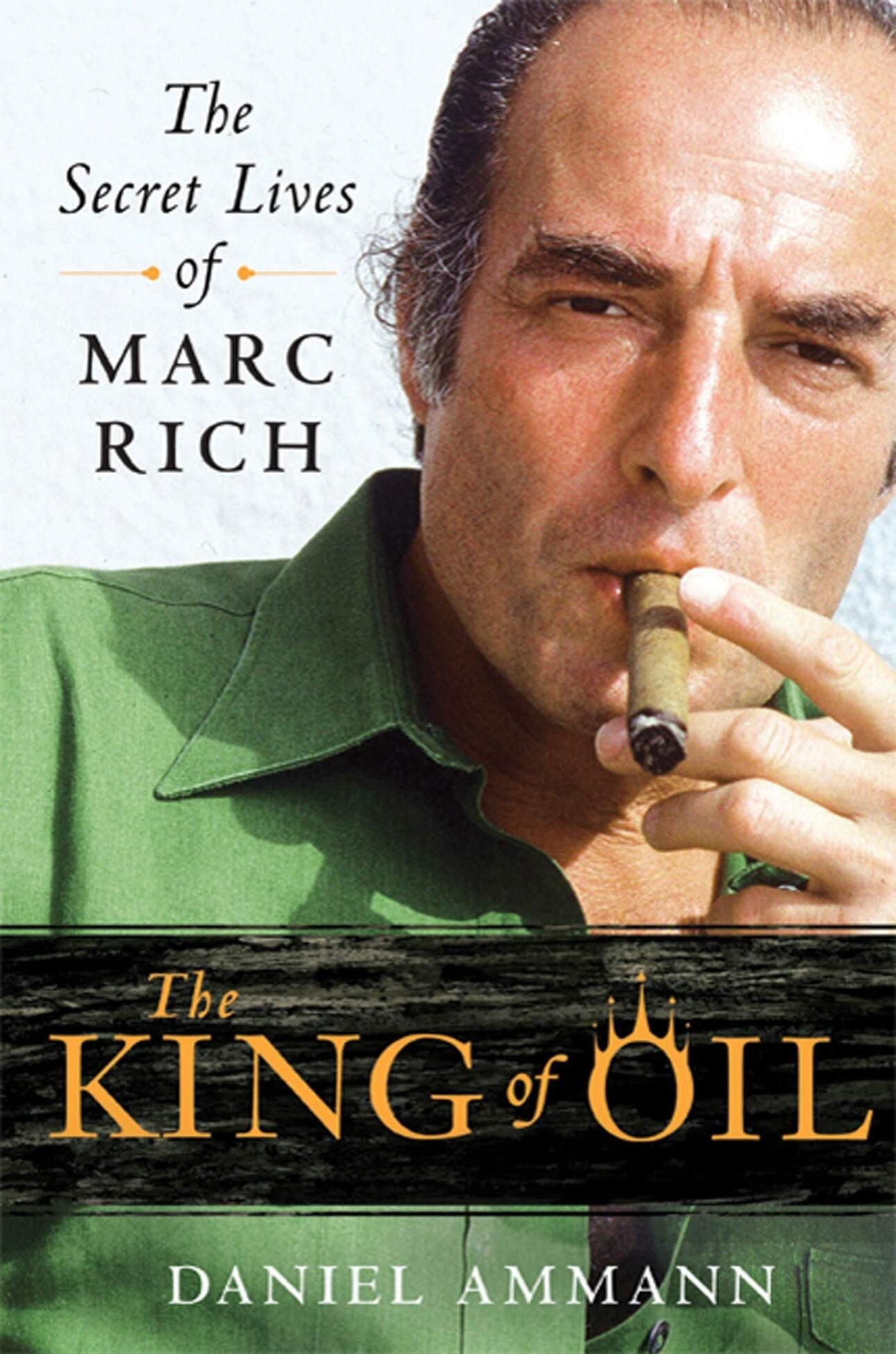

In 1974, Rich co-founded Marc Rich + Co AG in Switzerland, which would later become Glencore, now one of the largest commodities trading firms in the world. He revolutionized the industry by dealing directly with oil-producing nations, introducing high-risk but highly profitable trading strategies. His ability to navigate complex geopolitical landscapes and his willingness to operate in emerging markets helped transform global trade.

Beyond business, Rich was a strong supporter of Jewish causes, medical research, and cultural initiatives. He contributed significantly to Israel, funding programs that supported Ethiopian Jewish immigration and investing in cultural and educational institutions. His philanthropy extended beyond the Jewish community, financing medical advancements and supporting the arts worldwide.

Marc Rich passed away on June 26, 2013, at the age of 78. His legacy endures as one of the most influential figures in commodities trading, a visionary who redefined how global resources were bought and sold. His pioneering strategies continue to shape the industry today.

Marc’s Life Lessons

1. Master making deals in any environment

Mark Rich’s success wasn’t just about taking risks, it was about mastering negotiation and adaptability in the most unpredictable environments. While others relied on conventional supply chains and standard trade agreements, Rich saw global markets differently. He didn’t just accept the market as it was—he redefined it by building direct relationships with producers and buyers, often cutting deals that major corporations considered impossible. One of his most audacious moves came during the Cold War when he arranged deals for Soviet oil exports, something few Western traders dared to attempt. He recognized that politics and trade were deeply intertwined, but instead of seeing barriers, he saw leverage. His ability to navigate high-stakes negotiations in volatile environments made him one of the most influential commodity traders in history.

Success isn’t just about spotting opportunities, it’s about knowing how to create them, even in the most complex and unpredictable landscapes. Rich’s career is a testament to the power of adaptability and strategic thinking. Mastering the art of negotiation and understanding human nature can open doors that seem firmly shut.

2. Build a network that opens doors

Marc Rich understood that success in business isn’t just about knowledge or instinct,it’s about relationships. He built a network that stretched across the globe, from oil ministers in the Middle East to mining executives in Latin America and financial powerhouses in Europe. Rich bypassed traditional middlemen and forged direct connections with suppliers and buyers, creating an entirely new model for commodities trading. His ability to cultivate trust and maintain discretion made him the go-to trader for deals that others couldn’t access. A defining example of his networking genius was his role in securing oil deals with Iran after the 1979 revolution. While major corporations hesitated due to geopolitical tensions, Rich leveraged his deep relationships and understanding of international markets to keep oil flowing to clients. His success wasn’t about simply knowing the right people, it was about creating lasting, mutually beneficial relationships that ensured access to resources and opportunities when others were locked out.

Opportunities don’t just appear, they are often unlocked by the strength of your network. Rich’s career underscores the importance of building meaningful, strategic connections and maintaining them over time. Investing in relationships and trust can open doors that no amount of skill or capital alone ever could.

3. Adaptability is the ultimate advantage

Rich thrived in a world of uncertainty because he understood that adaptability was the greatest edge in business. While others played by the conventional rules, he embraced volatility, turning shifting global events into opportunities rather than obstacles. His approach was not about predicting the future—it was about preparing for multiple outcomes and having the agility to move quickly when conditions change. This ability to pivot made him one of the most successful commodities traders of all time. A defining moment came in the 1970s when the Arab oil embargo sent shockwaves through the global economy. While major oil companies struggled to navigate supply shortages, Rich adapted by forging new routes, securing oil from countries others overlooked, and ensuring a steady supply to his clients. His ability to move fast in unpredictable conditions earned him both admiration and immense profits.

Success doesn’t belong to those who resist change—it belongs to those who can navigate it. Rich’s career is a testament to the power of staying flexible, reading the landscape, and being ready to act when the moment demands it. Adaptability isn’t just an advantage, it’s survival.

The Quote of The Week

“Mankind has developed through ambitions. Some wanted to climb higher, some wanted to run faster, some wanted to fly, others to dive. I wanted to succeed in business”

Reply